Fear not. I am not going to subject you to a detailed analysis of the economic and political consequences of Donald Trump’s recently implemented tariffs. While I do have a Ph.D. comprehensive field in international economics, I am not a finance guy or a bond trader. And I am not trying to make up an excuse for Trump’s implementation of this policy. I simply want you to consider another explanation for Trump’s tariff policy, which has nothing to do with the actual import and export of goods and services, and everything to do with reshaping the US balance sheet, particularly with respect to short-term debt.

As of the most recent data available, the U.S. government’s short-term external debt stood at approximately $8.66 trillion as of September 2024. This figure represents obligations that are due within one year and includes debt held by the general government, central bank, deposit-taking corporations, and other sectors.

The current interest rate on U.S. short-term debt varies depending on the maturity of Treasury bills:

- 1 Month T-Bill: 4.30% as of April 4, 2025.

- 3 Month T-Bill: 4.28% as of April 4, 2025.

- 6 Month T-Bill: 4.16% as of April 4, 2025.

- 1 Year T-Bill: 3.89% as of April 4, 2025.

These rates reflect the yields on marketable obligations with maturities of one year or less. The federal short-term rate for April 2025 is slightly lower at 4.16% annually, based on IRS calculations. Stated simply, that is a lot of money in interest the US is paying to service the debt.

Today, April 4, 2025, yields on U.S. long-term Treasuries experienced a significant decline as a result of the tariffs:

- 10-Year Treasury Yield: Fell below 4%, closing at 3.97%, marking its lowest level since October 2024

- .This drop was driven by heightened recession fears following President Donald Trump’s announcement of aggressive tariffs on imports, which led investors to seek safety in government bonds

- .The decline reflects concerns about potential global economic downturns and increased demand for safe-haven assets like U.S. Treasuries.

In other words, the US Government received more money for a bond today than it did yesterday, and the US Government obligation to pay interest has shrunk. I had lunch with a good friend today, who has access to Trump financial officials, and he said this is the real purpose of the tariffs — i.e., restructure the US balance sheet, shrink the deficit and reduce the amount of short-term debt owed by the US Government.

I was told that if the average US citizen understood how fragile the US financial system is, especially from the burden of short-term debt, that this could cause a panic, followed by an economic crash. Trump is behaving like a magician — i.e., asking people to focus on potential trade benefits and increased jobs, while doing financial legerdemain.

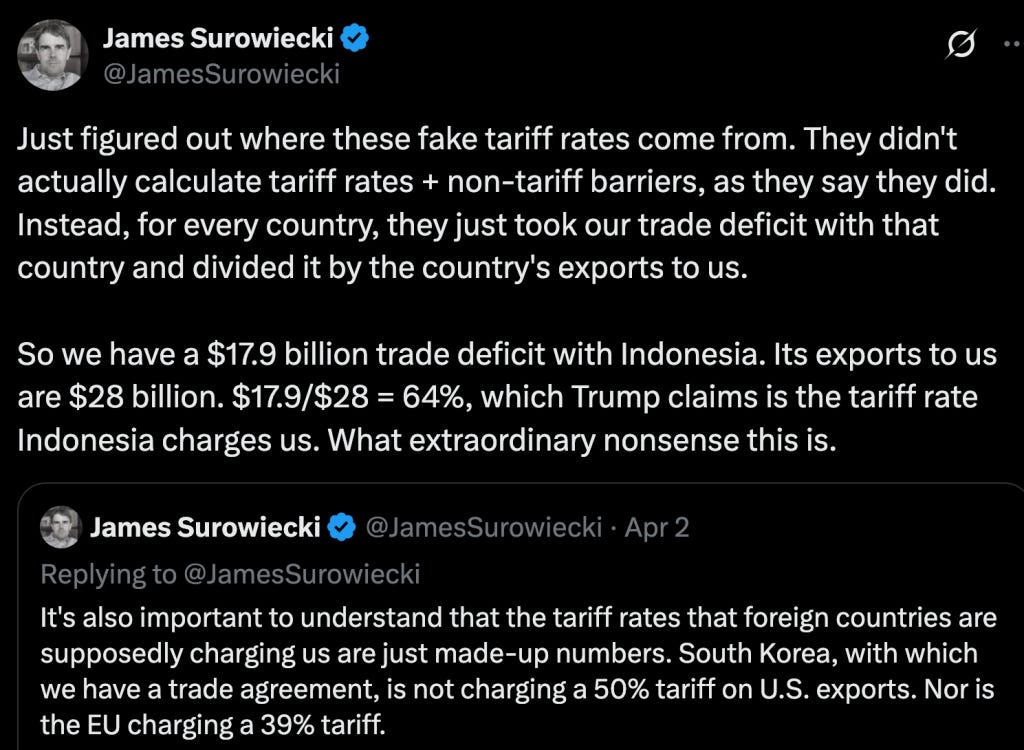

James Surowiecki posted on X and excellent summary that exposes the tariff rates as fake:

.

.

While the tariff scheme is being attacked — correctly in my view — as a misguided trade policy, I have come to believe that is not Trump’s true objective.

Let me use a crude, oversimplified example, to explain what I thinkTrump is trying to do. Imagine that you are buying a home, and that you have a 10 year $500,000 dollar interest only loan at 4.5%. At this rate, your monthly payment is $1,875. Now, what happens if that rate falls to 2.5%? Your new payment would be $1,041.67. You would have gained almost $10,000 dollars in your pocket by the end of the year (assuming you did not spend the savings). In other words, Trump is using tariffs in a bid to refinance the US debt at a lower rate. Remains to be seen if this works.

What happens if you are paying 4.5% interest on 8 trillion dollars in one year? You will pay $360 billion in interest. Let’s drop the rate to 2.5% for one year. You are now paying $200 billion in interest. Hell, with savings like that, Trump can buy a fleet of new aircraft carriers (kidding). That is what Trump is trying to accomplish. [Note, if I screwed up the math I will rely on you financial geniuses out there to set me straight.]

Refinancing onerous debt is something Trump has done multiple times in his business career, and managed to become a billionaire in the process. Whatever objections you have about other Trump policies, particularly Ukraine and the Israel/Palestine war, don’t make the mistake of assuming he’s stupid on this one and does not know what he is doing. Still, it is a gamble. We’ll have to wait a couple of months to see it this was a desperate Hail Mary pass or a shrewd, albeit risky, financial deal.

This topic did not come up in my chats today with Nima and with Judge Napolitano and Ray. We focused on Yemen, Iran and Ukraine:

*

Click the share button below to email/forward this article. Follow us on Instagram and X and subscribe to our Telegram Channel. Feel free to repost Global Research articles with proper attribution.

Featured image is from Son of the New American Revolution

Global Research is a reader-funded media. We do not accept any funding from corporations or governments. Help us stay afloat. Click the image below to make a one-time or recurring donation.

No comments:

Post a Comment