Part I

Global Research, February 10, 2020

The Trump regime never tires of trumpeting the myth of American ‘energy independence’. The foreign policy establishment in Washington sees America’s emergence as the worlds largest oil exporter as giving a huge boost to the achievement of U.S. geo-political goals. In his testimony to the House Foreign Affairs Committee Kenneth Medlock, Senior Director of the Center for Energy Studies at Rice University’s James A. Baker Institute for Public Policy, stated:

“Nevertheless, the growth in US oil production is transforming the status quo and shifting the geopolitical balance. This highlights the importance of the so-called ‘shale revolution’ in achieving US geopolitical and foreign policy aims.”

In recent years we have seen how the U.S. has weaponized its huge production of oil and gas to attack its geo-political rivals.

President Trump’s abandonment of the Iran nuclear deal and reimposition of sanctions on Tehran was based on the premise that the drop in Iranian oil exports would be made up for by U.S. shale oil production. Thus keeping down any inflationary pressures on the global oil market.

Trump’s strategy may have failed to totally stop Iranian oil exports, but the sanctions are inflicting significant economic damage and great suffering on the people, triggering mass protests in Tehran and other cities.

Trump has also used America’s record gas production as a carrot and stick with which to try and undermine Russian exports to Europe. At the recent Davos summit Trump dangled the carrot of cheap American gas to his European allies:

“With an abundance of American natural gas now available, our European allies no longer have to be vulnerable to unfriendly energy suppliers either. We urge our friends in Europe to use America’s vast supply and achieve true energy security. With U.S. companies and researchers leading the way, we are on the threshold of virtually unlimited reserves of energy, including from traditional fuels, LNG [liquefied natural gas], clean coal, next-generation nuclear power, and gas hydrate technologies.”

Trump has also used the stick to force Europe away from Russian gas supplies. Under the terms of the misnamed ‘Protecting Europe’s Energy Security Act of 2019, a sanctions law ironically written by oil and gas rich Texas Senator Ted Cruz,’ the U.S. has threatened EU countries with sanctions if they participate in helping with the construction of Russia’s Nord Stream 2 pipeline under the Baltic sea.

Ironically, the pipeline has almost been completed and the American sanctions are a case of too little too late.

We could go and look at other cases such as Venezuela where the U.S. has used its position as the world’s top oil producer to try and destroy that nation’s economy.

The record production of oil and gas has fuelled the hubris that underpins the manoeuvres of the American empire as it seeks to undermine and/or destroy its geo-political rivals.

This belief that the Shale Revolution will continue for decades into the future giving the American empire even greater power is based on a fundamentally flawed set of assumptions.

Shale Revolution based on fantasy thinking regarding geology

The prospect of the United States becoming a net exporter of oil or ‘energy independent’ has fuelled fantasy thinking amongst the geo-political strategists of the American empire. Both presidents Obama and Trump have enthusiastically trumpeted this belief.

The myth of American energy independence, thus ending its reliance on oil from the volatile Middle East, is based on Alice in Wonderland forecasts for shale oil and gas production from the highly influential U.S. Energy Information Agency (EIA).

The EIA 2020 forecast is for shale oil production to peak in 2022 at 14 million barrels per day and continue at that level until 2050. The vast majority of this oil production is expected to come from the shale oil pays in just 3 states: Texas, New Mexico and North Dakota. The bulk of this oil production is expected to come from the world’s largest oil field in the Permian basin that runs across Texas and New Mexico.

Let us put to one side the EIA’s failure to factor in the impacts of recessions, environmental disasters and its highly unrealistic assumption that energy consumption in America will only grow by 0.3% a year until 2050.

A growing body of evidence suggests that the EIA is basing its forecasts on very unrealistic assumptions regarding the geology of American shale plays.

The highly respected Desmog news has warned since 2018 that forecasts for shale oil production were highly unrealistic, makes the humorous observation that ‘Rocks don’t care if CEOs promise oil’ and that the EIA, ‘can’t make oil appear where there isn’t any.’

More and more evidence is emerging that the shale oil plays maybe nearing peak production which will be followed by decline.

Last November IHS Markit, which has 5,000 analysts providing economic data to over 50,000 customers worldwide, produced a report that predicted that U.S. shale oil production is headed for a ‘Major Slowdown’.

According to Raoul LeBlanc, vice president for North American uncoventionals, IHS Markit, shale oil production will peak by 2020 and that by 2021 U.S. oil production growth will have halted:

“Going from nearly 2 million barrels per day annual growth in 2018, an all-time global record, to essentially no growth by 2021 makes it pretty clear that this is a new era of moderation for shale producers. This is a dramatic shift after several years where annual growth of more than one million barrels per day was the norm.”

The problem oil companies face is that the decline rate of shale oil wells are frighteningly rapid at a rate of 70% in the first year and 30% in the second year of operation. This means they have to keep pumping and drilling new wells like mad to just to keep up production levels.

The Journal of Petroleum Technology has pointed that this poses major problems for the U.S. shale industry:

“These high late-stage decline rates represent a clear challenge for current reserves and ultimate recovery estimates from wells that were expected to produce economically for 30 or more years.’’

This is in sharp contrast to conventional oil wells which have an average decline rate of 6.7% and have much longer lives. Most of the world’s giant oil fields were discovered in the first half of the 20th century yet are still producing over 50% of global oil supply.

The IHS Markit report has found that the base decline rates of more than 150,00 producing oil wells in the Permian basin rose from 34% in 2018 to 40% in 2019.

According to Raoul LeBlanc:

“Base decline is the volume that oil and gas producers need to add from new wells just to stay where they are—it is the speed of the treadmill. Because of the large increases of recent years, the base decline production rate for the Permian Basin has increased dramatically, and we expect those declines to continue to accelerate. As a result, it is going to be challenging, especially for some companies with cash constraints, just to keep production flat.”

Further cold water on the EIA’s super optimistic forecasts for American shale oil production comes from Mark Papa, a closely followed pioneer of the shale industry and CEO of independent oil and gas company Centennial Resource Development.

At a gathering of oil industry executives in 2018 Papa warned that there was a growing shortage of tier 1 acreage i.e. oil wells with the highly productive sweet spots. Papa stated that the U.S. shale industry faces a major challenge posed by the geology of shale plays:

“There are good geological spots in shale plays and weaker geological spots, and a lot of the good geological spots have already been drilled.“My theory is that you’ve got basically resource exhaustion that is beginning to take place. It’s no secret that you’ve only got three shale oil plays in the U.S. of any consequence. The rest of them don’t amount to a hill of beans.”

Papa further warned that the American shale industry will face major changes in the 2020s as most oil plays face rapid depletion rates and that OPEC oil will become more important as the decade progresses. He believes that the second and third biggest oil plays: the Eagle Ford in Texas and Baaken in North Dakota have already peaked forcing drillers to move to far less productive acreage.

Permian Basin which contains the highest producing plays in America is flat lining

Of greater concern are the reports warning that the Permian basin, the jewel in the crown of America’s fracking industry, is approaching peak production.

In 2018 Paul Kibsgaard CEO of Schlumberger, one of the oil industry’s largest service provider, warned, “We are already starting to see a similar reduction in unit well productivity to that already seen in the Eagle Ford, suggesting that the Permian growth potential could be lower than earlier expected.”

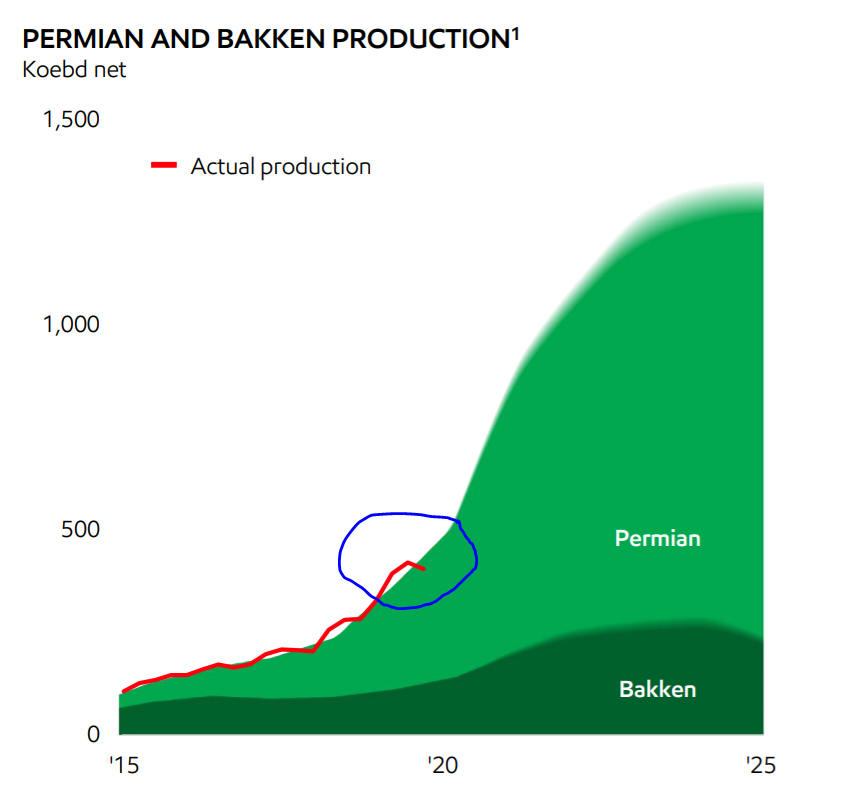

This is supported by Javier Blas, chief energy correspondent for Bloomberg News who recently tweeted that oil production in both the Permian and Baaken are slowing down:

David Hughes, a scientist who worked for 32 years with the Canadian Geological Survey, has carried out an exhaustive analysis of the EIA claims for U.S. shale production up to 2050. His 177 page report SHALE REALITY CHECK 2019 Drilling into the U.S. Government’s Optimistic Forecasts for Shale Gas & Tight Oil Production Through 2050 concludes that EIA forecasts through 2050 are,’extremely optimistic for the most part, and are therefore highly unlikely to be realized.’

In the chapter of his report on the Permian basin Hughes notes that:

“… in Reeves County, which was the top producing county in the Permian Basin as of April 2019, well productivity appears to have flat-lined in 2018. Reeves County has seen the most horizontal wells drilled since 2011 of any county, and the flat-lining of productivity gains suggests sweet spots there may be reaching their limits and over-drilling may be taking its toll. … Over-drilling will not increase ultimate recovery, although it may allow resources to be recovered sooner.’’

Hughes examines the top 3 plays in the Permian basin (Spraberry, Wolfcamp and Bone Spring) in forensic detail. His analysis of the Spraberry play which is the highest producing play in the Permian basin reveals how the EIA forecast for shale oil production up-to 2050 is totally unrealistic and impossible to achieve.

Spraberry Play in the Permian Basin

The Spraberry play contains over 44,922 wells. To achieve the EIA forecasted levels of production it would have to achieve well densities of 8.1 per square mile which seems highly unrealistic as spacing wells too close together has the effect of lowering production.

Even worse it appears the EIA is engaging in wilful deception in its forecasts of shale oil production. How else do you explain the EIA forecasting that the Spraberry play will achieve its massive production levels up until 2050 by a 225% overshoot of its own estimates of proven resources plus unproven reserves!

Hughes points out:

“Even if … 100% of the EIA’s proven reserve plus unproven resource estimates could be recovered by 2050, 8.33 billion barrels are missing to meet the EIA production forecast. – The EIA’s reference case production forecast is not consistent with its own estimates of proven reserves plus unproven resources—6.65 billion barrels are available from its estimates, whereas its production forecast requires recovery of 14.98 billion barrels over 2017–2050.’’

This begs the question where are the 8.33 billion barrels of missing oil to come from? It would appear that they exist nowhere but in the imaginations of EIA officials.

Hughes conclusion is rather damning for the Shale Revolution narrative

The key findings of his report seriously undermine the whole energy independence narrative of the Washington establishment and should give the geo-political opponents of the U.S. some encouragement.

“Well productivity has increased in most plays through focusing on sweet spots and due to longer horizontal laterals and increased volumes of water and proppant, as well as more fracking stages. The limits of technology and exploiting sweet spots are becoming evident, however, as in some plays new wells are exhibiting lower productivities.’’

For the U.S. shale industry to meet EIA forecasts Hughes estimates that the fracking industry would have to increase production not just from the big 3 plays (Permian, Eagle Ford and Baaken) that produce 85% of American oil but also from the older plays that are already in decline. To meet the EIA forecasts, ‘1,892,854 additional wells would be needed by 2050 to meet the forecast, at an overall cost of $13 trillion.’

Hughes concludes that the:

“shale revolution” has sparked calls for “American energy dominance’’ despite the fact that the U.S. is projected to be a net oil importer through 2050, even given EIA forecasts. Although the “shale revolution” has provided a reprieve from what just 15 years ago was thought to be a terminal decline in oil and gas production in the U.S., this reprieve is temporary, and the U.S. would be well advised to plan for much-reduced shale oil and gas production in the long term based on this analysis of play fundamentals.’’

Consequences

The peak and subsequent decline of shale oil production will have an impact upon the American economy and its massive trade deficit. Once again it will become more heavily dependent on oil production from overseas increasing the costs for industry and consumers.

If American shale oil production goes into decline during the 2020s it will weaken the influence of Washington over oil markets and reduce its ability to destroy the exports of major oil producers such as Iran and Venezuela. Washington will not be able to so easily contain the inflationary pressures on oil prices from taking out the oil production of such major producers.

Oil production from countries that Washington designates as enemies, such as Russia, Iran and Venezuela, will increase in importance on the global market as U.S. shale oil production starts to decline. This will give greater power and influence to OPEC and Russia when it comes to determining oil prices through production cuts/increases.

As the shale industry declines it will add greater impetus to American efforts to control the oil producing countries of the Middle East. Nations from Iraq to Saudi Arabia are developing trade and infrastructure relations with China which the United States takes strong exception to.

Take for example, the recent bombshell admission by Iraq’s caretaker Prime Minister that Trump threatened him with assassination if Iraq proceeds with an oil for infrastructure project with China. In the first phase of this deal Iraq will send 100,00 barrels of oil to China in return for a $10 billion credit. China would finish the building of the country’s electricity grid and other major infrastructure projects including its vital oil and gas sector.

According to Al-Monitor, the Iraqi PM’s financial adviser revealed on 23 December that the, ‘’most important provision in the China-Iraq agreement is to open an account for Iraq in Chinese banks to deposit oil funds. With that, Iraq can gradually do without its US accounts, according to parliamentary blocs that want to expel US forces from the country.’’

The United States sees such economic ties as mortal threats to the entire Petro-dollar system as Iraq would be able to bypass the American control of its oil trade which is denominated in U.S. dollars which are held in account with the Federal Reserve bank in New York.

The Petro-dollar system set up by Kissinger in the 1970s underpins the American control of the global trading system and allows it to maintain a massively over bloated military the scale of which the world has not seen since World War 2.

The American empire’s policy of regime change towards oil rich countries that do no support Washington’s agenda will see no let up. Indeed, it is liable to be stepped up.

As U.S. shale oil production declines it will seek to maintain control over the regions oil production. China’s desire for growing amounts of Middle Eastern oil will intensify this clash for resources, influence and power in the region. Thus leading to greater geo-political and economic conflict.

*

Note to readers: please click the share buttons above or below. Forward this article to your email lists. Crosspost on your blog site, internet forums. etc.

The original source of this article is Global Research

Copyright © Dr. Leon Tressell, Global Research, 2020

https://www.globalresearch.ca/american-empire-mistakenly-believes-shale-revolution-continue-until-2050-beyond/5703191

Counter Information published this article following the Creative Commons rule. If you don't want your article to appear in this blog email me and I will remove it asap.

No comments:

Post a Comment